TL;DR

- CS2 skin prices stabilized after November 2023 lows, with premium items showing slight recovery while budget skins remain volatile

- Market decline driven by technical changes, player base fluctuations, and psychological factors rather than fundamental economic collapse

- Investment timing requires monitoring Valve’s content updates and market sentiment indicators for optimal entry points

- Mid-tier skins like AK-47 variants demonstrate resilience and may offer better risk-adjusted returns

- Successful skin investing demands patience, research, and understanding of Counter-Strike’s 20+ year market cycles

Games and Esports Articles CS 2

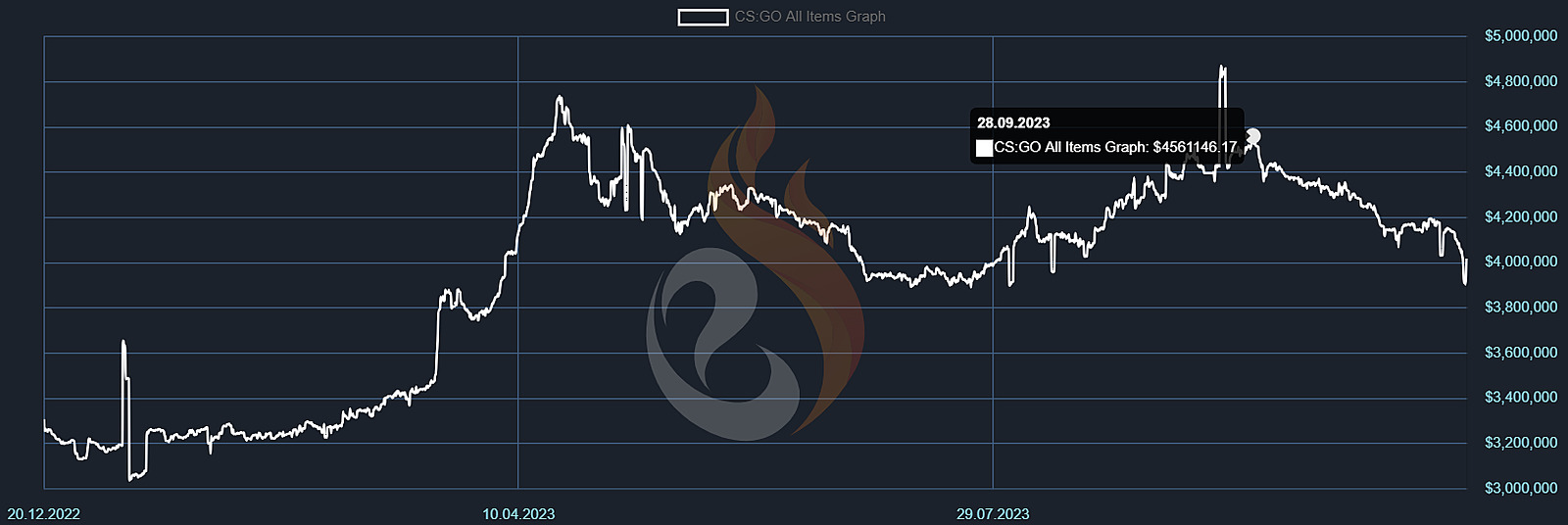

Update, January 1, 2024: Our initial analysis captured the market bottom in mid-November, and subsequent developments have largely validated our projections. The player community has experienced modest growth since our last assessment, though not at the explosive rates some optimists predicted. Market stabilization patterns emerged clearly: December witnessed a brief price surge followed by moderate correction. From a broader perspective, the fundamental market conditions remain consistent with our earlier evaluation.

Premium “fluid” category skins have demonstrated particular resilience, showing incremental appreciation in recent trading sessions. This suggests that high-quality assets maintain their appeal despite broader market uncertainty.

Original context: Counter-Strike 2’s launch triggered substantial skin depreciation across multiple asset classes. Elite-tier inventory items declined approximately 50% from pre-announcement peaks and continued their downward trajectory post-release. This market behavior generated significant discussion about underlying causes and future expectations.

Let’s conduct a comprehensive examination of this market correction to identify core issues and evaluate whether current price levels represent genuine investment opportunities.

Why do CS2 skin costs go down?

Market analysts and trading platforms lack consensus on precise causation. Multiple theories circulate regarding the skin value depreciation, with uncertainty about which factors exerted dominant influence. Here’s an expanded analysis of commonly cited explanations with additional market insights.

- CS2 anticipation bubble: The pricing surge during open beta testing reflected artificial inflation. Values escalated beyond sustainable demand levels. Current skin valuations have largely returned to pre-CS2 speculation levels, suggesting a market correction rather than collapse.

- Visual transformation challenges: Valve committed to migrating skins to the new engine. Some received visual enhancements while others suffered degradation compared to their CS:GO appearance. Finish wear patterns underwent significant alterations in the updated game environment.

- Developer communication gaps: The publisher implements unexpected modifications that directly impact skin aesthetics and perceived value.

- Technical launch complications: CS2 deployment encountered numerous bugs, performance inconsistencies, and community dissatisfaction that affected market confidence.

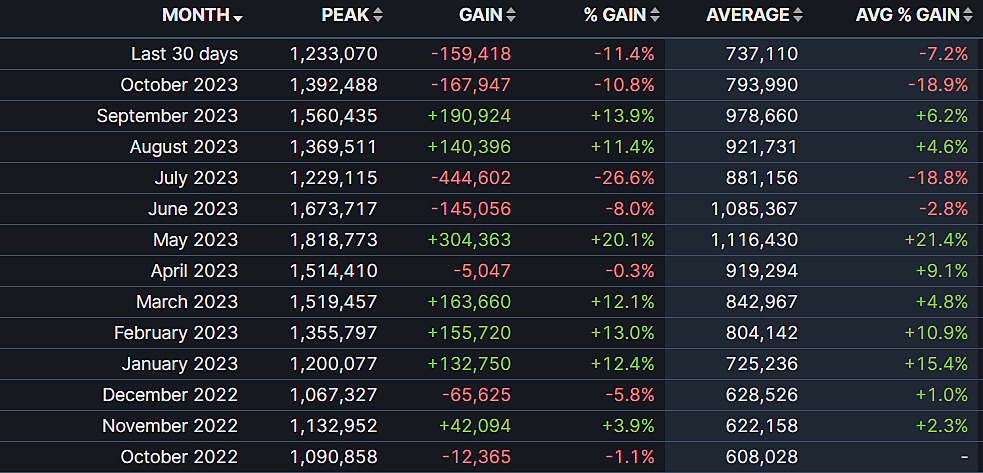

- Player engagement fluctuations: October witnessed an 18% reduction in average concurrent players. With reduced active participation, logical assumptions suggest diminished trading activity and market liquidity.

While determining primary causation remains challenging, the unifying element remains market psychology – specifically, fear-driven decision making. Traders, concerned about potential losses, initiated rapid divestment, triggering classic economic chain reactions. However, the situation appears less severe than initial reactions suggested, particularly nearly two months post-launch. Current indicators suggest gradual market normalization.

What are the longest maps in history of CS2 and CS:GO? How many rounds they had in pro CS on LAN and online

When both sides don’t give up.

What is the future of CS2 skin prices, and should you invest in them?

Let’s project potential future scenarios and conduct deeper analysis of the identified issues. Some concerns may represent exaggerated reactions or trader overestimation of risks.

Valve has maintained consistent CS2 patching cadence, resulting in measurable gameplay quality improvements. Players who experienced initial technical difficulties will likely return as initial concerns diminish.

October’s player reduction follows historical patterns; this month consistently demonstrates engagement volatility. Additionally, current average player counts exceed year-ago levels. Remember that Counter-Strike boasts over two decades of market history, and CS:GO’s initial reception was significantly more challenging.

Valve maintains unpredictable publishing behavior, but substantial skin transaction revenue flows directly to their accounts. They possess both incentive and capability to monitor market conditions and implement corrective measures when necessary. While comprehensive skin visual fixes seem improbable, the broader CS2 economy should avoid catastrophic failure.

High-value skins experienced notable depreciation, yet they haven’t breached pre-CS2 announcement valuation floors. However, entry-level skins present entirely different market dynamics.

S1mple: “I’m not old enough to move to Valorant because I want to kick asses in CS:GO”

Mid-tier and cheap skins demonstrate divergent market behavior

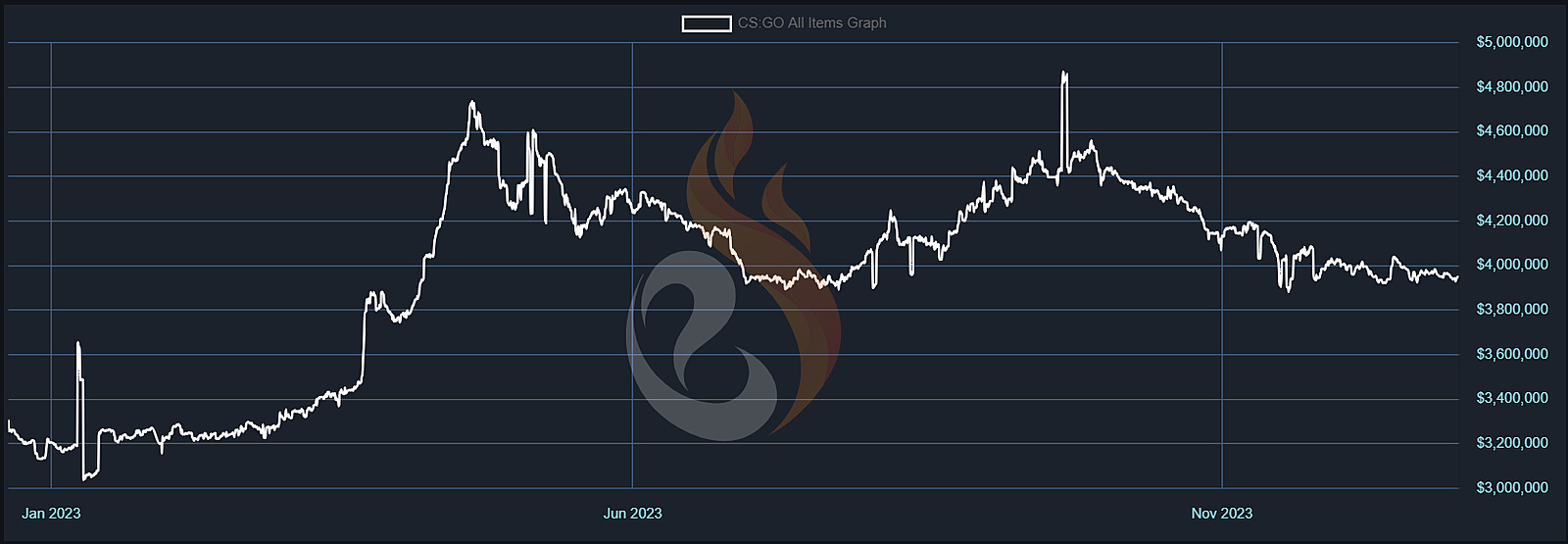

Analytical platform EsportsFire provides comprehensive “all CS items” data illustrating cost fluctuations throughout the past year. Right-side metrics represent “accumulated price” calculations. The dual peaks correspond to announcement anticipation and pre-release growth phases. Clearly observable patterns indicate final valuations substantially exceed 2022 averages.

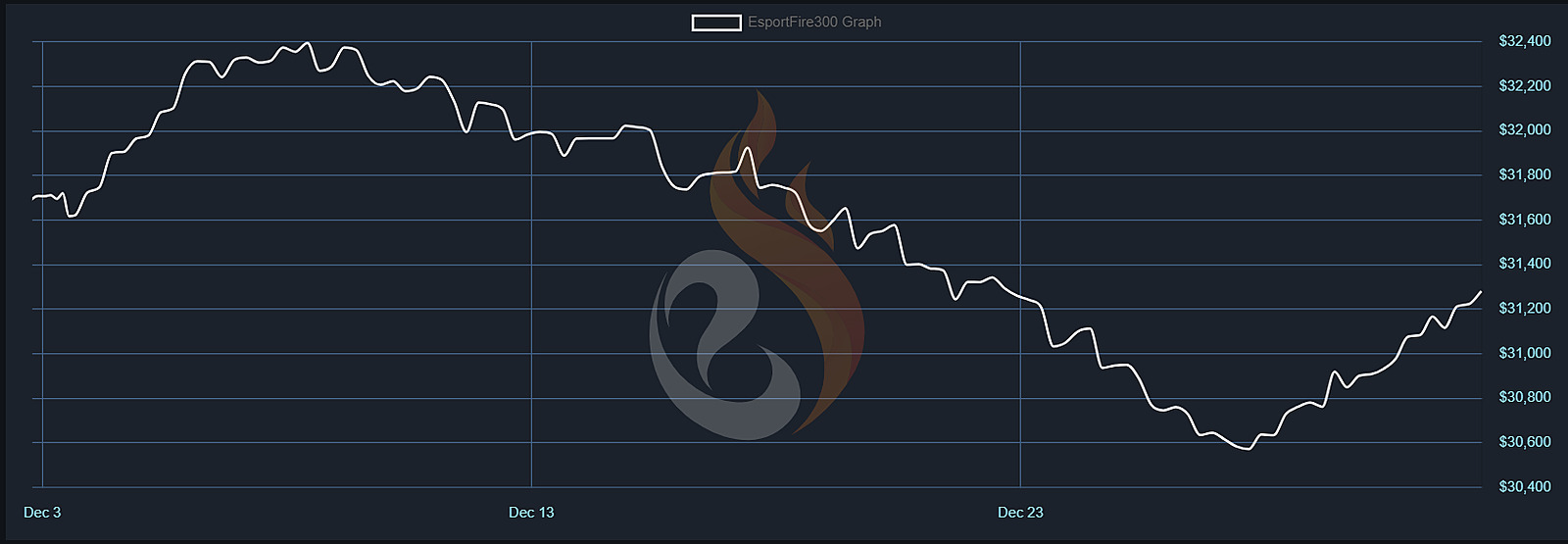

The article from the same analytical source suggests mid-range inventory items may sustain economic momentum. Certain popular skins including AK-17 | Rat Rod, AK-47 | Black Laminate, AK-47 | Cartel have demonstrated consistent appreciation since CS2 deployment. Potential explanations include visual preference shifts driving smaller traders and regular users toward alternative investment focuses.

This market phase could represent significant transition in skin investment trends. While definitive investment timing recommendations remain challenging, we suggest awaiting clearer market stabilization signals. One crucial factor frequently overlooked during market panic: Valve hasn’t introduced substantial new CS2 content. Even limited case releases could influence player engagement metrics, and a major Operation might attract unprecedented participation compared to previous CS:GO updates.

Valve changes weekly skin/case drops in CS2. How to get Care Package rewards in CS2

We have a choice now.

Strategic Skin Investment Framework

Successful CS2 skin investing requires systematic approach rather than emotional reactions. Here’s a comprehensive strategy framework developed from analyzing historical market cycles and current conditions.

Market Monitoring Essentials: Track key indicators including player count trends, major tournament schedules, and Valve development announcements. These factors historically correlate with skin price movements and can provide early warning signals for both opportunities and risks.

Common Trader Mistakes to Avoid:

- Panic selling during corrections: Historical data shows most significant declines recover within 3-6 month periods.

- Overconcentration in single asset classes: Diversify across premium, mid-tier, and budget categories to mitigate specific market segment volatility.

- Ignoring fundamental skin characteristics: Focus on skins with proven historical performance, community popularity, and visual appeal that transcends game engine changes.

- Timing market peaks and troughs: Instead of attempting precise timing, employ dollar-cost averaging strategies across market cycles.

Portfolio Allocation Guidelines: Consider dividing skin investments across risk categories: 40% in established premium skins with proven track records, 35% in resilient mid-tier performers, and 25% in high-potential budget options.

Entry Point Identification: Monitor trading volume patterns – sustained increases in buying activity often precede price appreciation. Additionally, track community sentiment through Reddit discussions and professional trader forums for early trend detection.

For those seeking comprehensive gaming strategy guidance beyond skin trading, our Complete Guide provides detailed tactical frameworks applicable across multiple gaming domains.

Action Checklist

- Monitor SteamDB player count trends and community sentiment indicators weekly

- Research historical price performance for target skins using EsportsFire and Steam Market history

- Diversify acquisitions across premium, mid-tier, and budget categories

- Set price alerts for specific skins at strategic entry points (typically 15-25% below recent highs)

- Review Valve update notes and community patch reactions for market impact assessment

No reproduction without permission:SeeYouSoon Game Club » Why do CS2 skin prices go down? What’s going on with CS2 market decrease and should you invest in skins right now? [Updated, 2024] Understanding CS2 skin market volatility and making informed investment decisions in 2024